property tax assistance program calgary

2020 Municipal Non-Residential Phased Tax Program PTP On Feb. Box 2100 Station M Calgary AB T2P 2M5.

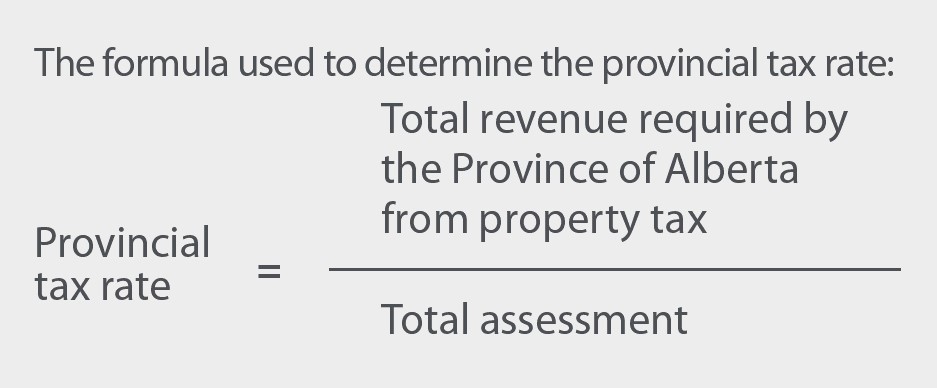

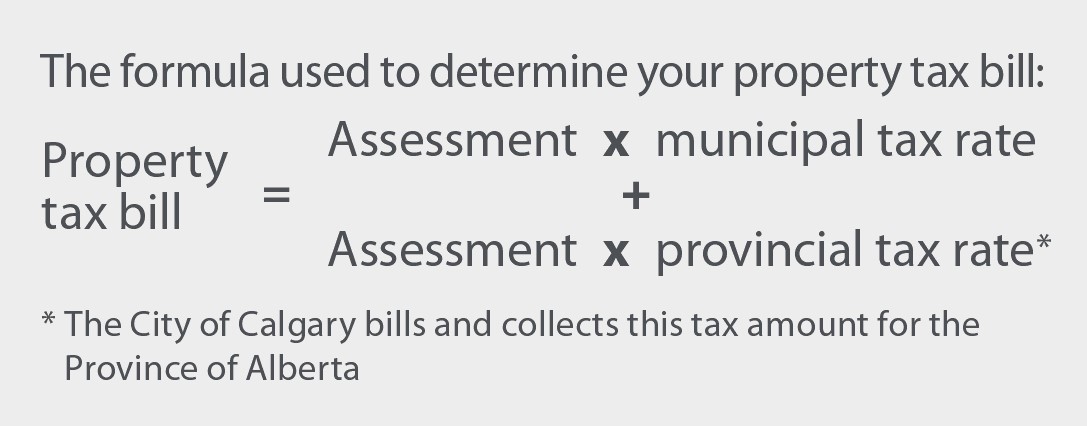

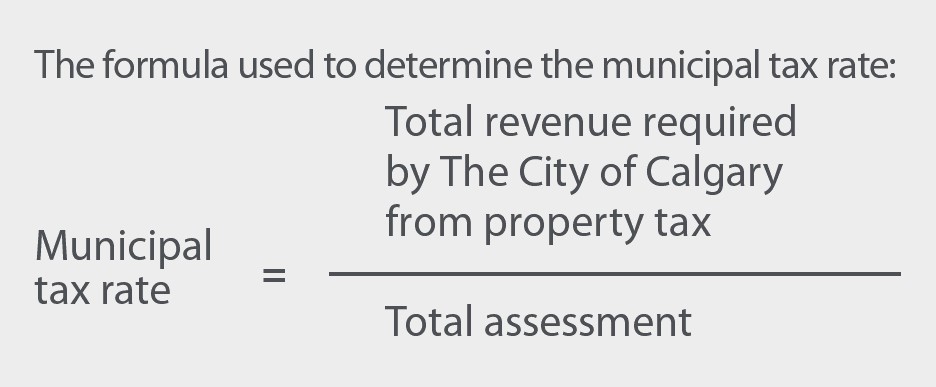

Property Tax Tax Rate And Bill Calculation

Personal information is collected in accordance with Section 33c of the.

. Apply by mail fax or drop-off. The 2022 property tax bill due date is June 30. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45810 or less among other.

Lost cats and dogs. Taxes and property assessment. Phased tax program for commercial property owners.

Add Calgary Property Tax payee to your bank accounts bill payment profile. In order to ensure that property taxes are directed correctly it is important that all property owners are designated on the School Support Notice and that the percentage of ownership adds up to 100. You need to file taxes to receive social assistance benefits.

Property Tax Assistance Program Web property for a minimum of one year from date of purchase. Calgary property tax and select the payee name. Drop-off at one of our in-person.

Tax exemption status is generally based on the belief that the use of the property returns a sufficient community benefit to society earning the relief of tax obligations. The City of Calgary recognizes the valuable societal contributions of certain organizations by granting municipal tax exemptions. Property Tax Assistance Program.

Property Tax Assistance Program. 3 2020 City Council approved 30 million in tax relief for Calgary businesses who have experienced the most significant municipal property tax increases over the past four years. For the 2021 tax year Council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship.

Add Calgary Property Tax as a payee. The process assesses your income eligibility for multiple city programs. All information submitted for property tax assistance is handled in a confidential manner.

Fair entry low income assistance. Web property for a minimum of one year from date of purchase. Fair entry low income assistance.

Apply for property tax assistance. The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion. Have experienced an increase in property tax from the previous year.

If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly. Visit wwwcalgarycaptap for more information or call 311. If there is insufficient space to list all the registered property owners and to make the necessary declarations on the front of this School.

Senior citizens over 65 years of age are eligible for Property Tax Assistance for Seniors Program which offers rebates of tax increases based on 2004 tax. This is done through a low-interest home equity loan with the Government of Alberta. Taxes and property assessment.

For more information about our programs visit property tax or Tax Instalment Payment Plan TIPP call 311 or 403-268-CITY 2489 if calling from outside Calgary. This is a development server and. Complete and sign the Fair Entry application form or large print version and then submit by.

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online by phone or in person at a branch. Own the property for a minimum of one year from date of purchase. Official web site of The City of Calgary located in Calgary Alberta Canada.

Meet the residency and income guidelines of the Fair Entry Program. Property tax assistance program Property tax assistance. Property Tax Postponement.

Taxes and property assessment. Apply now through Fair Entry and your one. The City of Calgary is supporting citizens and businesses in response to the COVID-19 pandemic.

Lost cats and dogs. 800 Macleod Trail SE Calgary Alberta T2G 2M3 Telephone. Property tax assistance program Property tax assistance.

The City of Calgary offers a variety of property tax payment options to pay directly to The City or through your bank. Own no other City of Calgary residential property. The Tax Instalment Payment Plan TIPP suspended its 2 filing fee and there was no initial payment required for taxpayers.

The Citys Fair Entry program wwwcalgarycafairentry. The approved 2020 Non-Residential Phased Tax Program PTP will cap eligible property owners non-residential. A creditgrant of the increase on the property tax for eligible low-income Calgarians.

Anyone who is approved will receive an additional rebate from Waste and Recycling Services. Own your own home and reside in your home. Call us at 311 or visit Calgarycafairentry.

The 2022 property tax bill due date is June 30. Social programs and services. A creditgrant of the increase on the property tax for eligible low-income Calgarians.

Official web site of The City of Calgary located in Calgary Alberta Canada. You can find more information at calgarycaptap calgarycafairentry or by calling 311 or 403-268-CITY 2489 if calling from outside Calgary. Add Calgary Property Tax as a payee.

Under The Citys Property Tax Assistance Program residential property owners of any age may be eligible for a creditgrant. You may qualify for individual programs such as a Recreation Fee Assistance and Calgary Transit Low Income Transit Pass Program or household programs such as Property Tax Assistance Program Seniors Services Home Maintenance Program or No Cost Spay Neuter Program. Property Tax Assistance Program.

Property Tax Assistance Program This is an annual program that provides a creditgrant of the increase in property tax for your property. For the 2021 tax year Council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship. This process will assess your income eligibility for multiple City programs with a.

Social programs and services. Under The Citys Property Tax Assistance Program residential property owners of any age may be eligible for a creditgrant of the increase on their property tax. Own the property for a minimum of.

The City of Calgary Property Tax Assistance Program 2013 181000.

How Our Property Tax And Utility Charges Measures Up Nationally

Can A Shed Affect Property Taxes

Pembroke Property Tax 2021 Calculator Rates Wowa Ca

Coronavirus Canada Property Tax Deferrals By City Creditcardgenius

Does Alberta Have A Home Owners Grant For Property Taxes Cubetoronto Com

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Property Tax Tax Rate And Bill Calculation

Property Tax Assistance Program Core Alberta

How Our Property Tax And Utility Charges Measures Up Nationally

Property Tax Solutions Our Main Task To Help Property Owners Delinquent Property Tax Lampasa Property Tax Lampasas Co Tax Help Tax Preparation Property Tax

Property Tax Tax Rate And Bill Calculation

Seniors Property Tax Deferral Program Core Alberta

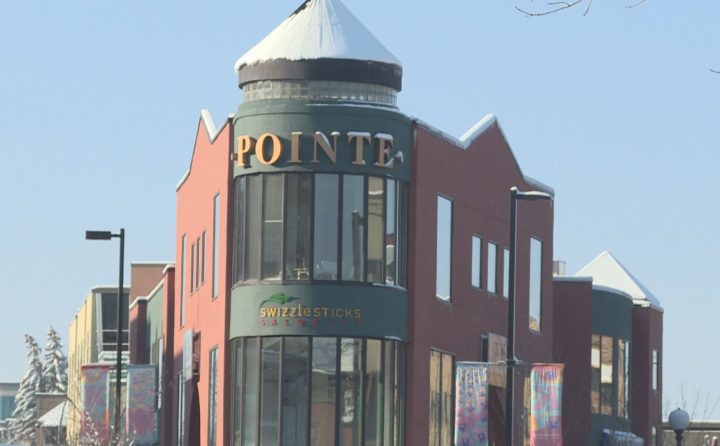

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

How To Lower Your Property Taxes In Calgary

Calgary Reducing Late Property Tax Fines For A 2nd Year Calgary Globalnews Ca

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News